Email:vip@taojiyun.com

Email:vip@taojiyun.com- ID:17154831823

- VIP:淘集运会员

- User Center Log Out

- My Shopping Cart My Order

-

~ Empty ~

-

~ Empty ~

Taojiyun 2025-01-21 20:09:35 1542k 0 0

Packages sent abroad need to pass through foreign customs, and customs inspections are basically in the form of random inspections. If the customs considers your package to be special (for example: large in size, too heavy, or contains sensitive items, etc.), the customs will generally take the initiative to contact the recipient to provide an invoice or customs clearance documents. If the package is returned or destroyed due to the inability to contact the recipient or the recipient does not cooperate in actively contacting the customs for customs clearance, the recipient will bear the costs incurred.

1. Risk Warning:

For the purchased goods, the system will issue a risk warning for your goods when submitting the order and reviewing. After the goods are sent to our warehouse, our company will recommend a mailing method with lower risks for you based on the attributes of the goods and logistics transportation experience.

Warm reminder: For some goods, there will inevitably be certain customs risks (such as a small probability of return, fines, taxes, etc.), and the risk will be borne by you. Please understand.

2. Declaration related:

For the goods purchased on behalf of others, please refer to the tariff thresholds and logistics transportation experience of various countries and make reasonable declarations (users can choose to declare goods independently or make vague declarations when submitting packages).

Warm reminder: The probability of a package being taxed depends on the frequency of customs inspections and the impact of policies. Please refer to the "Tariff Thresholds of Various Countries" for details. You will bear the customs-related risks (such as return of packages, fines, taxes, etc.). Please understand.

In addition, if your goods are heavy or the value of the goods is high, the probability of customs inspections will increase. It is recommended that you try to avoid packages that are too heavy or have too many similar goods.

What is a tariff?

The Customs is a unit under the Ministry of Finance of the government, responsible for customs duty collection, smuggling inspection, bonded storage, trade statistics, and accepting other customs commissions to collect taxes and fees and implement control. Tariffs are a type of tax levied by the customs on goods and articles entering and leaving the country or customs territory in accordance with the law. When you buy goods overseas through the Internet and then ship them back to Taiwan, it is considered an import behavior, so you must declare and pay tariffs to the customs according to the tax law.

Commodities with a duty-paid price of NT$2,000 or less are exempt from import tax

According to the "Import Duty-Free Regulations for Postal and Parcel Articles" and the "Value-Added and Non-Value-Added Business Tax Law", if the duty-paid price of imported parcels is less than NT$2,000, import tax is exempted. If it exceeds NT$2,000, the customs will levy import tax and business tax in accordance with the law after customs declaration.

※ Duty-paid price = product purchase price + international shipping fee + insurance fee

Taojiyun provides a tax-inclusive plan, with a maximum limit of NT$30,000 per order. Choosing tax-inclusive can reduce the probability of taxation. If you are a frequent importer, the "frequent import tax" levied by the customs will be borne by you, which is not included in the tax-inclusive plan.

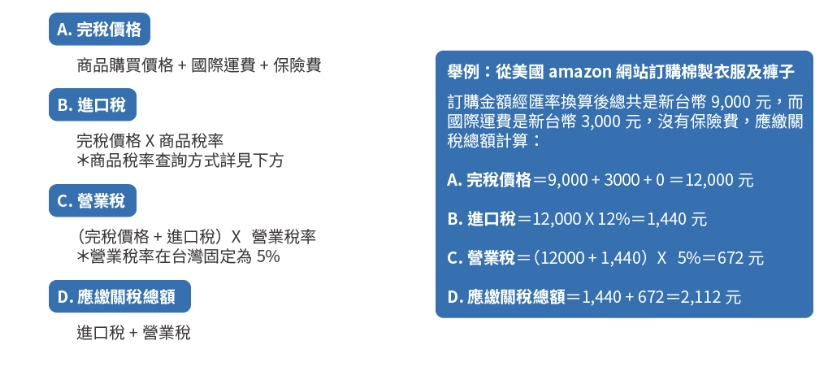

How to calculate import tariffs?

If the duty-paid price of an imported parcel exceeds NT$2,000, you can refer to the following tax calculation method to estimate the amount of tariff that may be paid.

How to pay tariffs?

After completing import customs clearance, if there is any tariff, you will be notified by email to pay the fee; please use online credit card or virtual account transfer, Taojiyun will help you collect and pay the customs without charging any other handling fees.

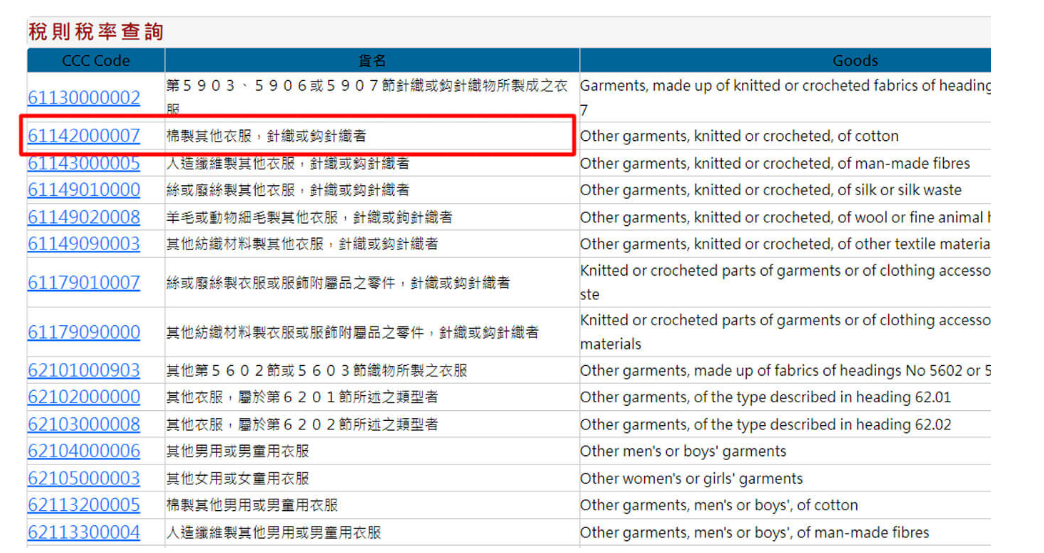

How to check the import tax rate?

Please use the Customs and Port Trade Single Window of the Ministry of Finance of the Republic of China "Tariff Rate Query System" and select the name of the purchased product for query, as follows:

1. Click on the comprehensive query of tariff rates

2. Enter the Chinese name of the product

3. According to the product description, click the corresponding CCC Code (the following takes cotton clothes as an example)

4. Please refer to the national tax rate of the product ((most products are subject to the tax rate in the first column)

Tao Jiyun International Shipping:

Tao Jiyun Purchasing currently provides domestic multi-platform online shopping and return services to Taiwan (for example: Taobao, Xiaohongshu, Douyin, 1688, Xianyu and other platforms), and also provides tax-inclusive and non-tax-inclusive service plans. Everyone can choose the return service according to the appropriate plan.

When the declared value of a general package is lower than the tariff threshold of the country, the package will usually not be taxed (but false declarations are another matter). If your package is taxed, you need to pay the tax yourself and assist in customs clearance, but the probability of this happening is very small. Currently, only 0.3% of packages are taxed.

Reference table of tariff thresholds for various countries:

| Country | Amount |

| United States | $800 |

| Canada | 20 Canadian dollars |

| UK | No exemption amount |

| Australia | 1000 Australian dollars |

| EU | 0€ |

| Russia | 10000 rubles |

| Japan | 10000 yen |

| Singapore | 300 US dollars |

| New Zealand | 300 U.S. dollars |

| Switzerland | 100 Swiss francs |

| Korea | 150 USD |

1. Switzerland's tariff threshold is 100 Swiss francs, and the VAT threshold is 65 Swiss francs.

2. Canada and European countries' customs are more strict in parcel inspections, and commercial express delivery companies such as DHL and UPS are more likely to be subject to tariffs.

List of taxes collected by various provinces in Canada

| Province of Delivery | GST service tax | PST Sales Tax | HST Consolidated Tax |

| Alberta | 5% | - | - |

| British Columbia | 5% | 7% | - |

| Manitoba | 5% | 8% | - |

| New Brunswick | - | - | 13% |

| Newfoundland and Labrador | - | - | 13% |

| Northwest Territories | 5% | - | - |

| Nova Scotia | - | - | 15% |

| Nunavut | 5% | - | - |

| Ontario | - | - | 13% |

| Prince Edward Island | - | - | 14% |

| Quebec | 5% | 9.98% | - |

| Saskatchewan | 5% | 5% | - |

| Yukon Territory | 5% | - | - |

How to avoid paying taxes?

You can refer to the following 3 suggestions:

1. The weight of the package is an important basis for the customs of various countries to determine whether the package is a civilian package or a commercial package. The probability of being regarded as a commercial package is relatively high if it exceeds 10kg, so please consider the weight of the package when submitting the waybill. If you choose DHL, you also need to consider the volume of the goods (DHL confirms the charges based on the volume and weight of the goods).

2. The upper limit of the package weight is set at 30kg. If it exceeds 30kg, you can submit the waybill separately, but it is recommended that each waybill should not exceed 10kg.

3. Excessive quantities of the same product are also considered as commercial packages. Please try to avoid using the same package to send a large number of the same product.

4. Of course, as you know, we cannot give you a 100% guarantee on whether your package will be taxed in the end.

Warm Tips:

An important basis for the customs of various countries to judge civil and commercial packages is the weight of the package and the number of items. The probability of being considered a commercial package is relatively high if it exceeds 10KG, so when submitting the waybill, please confirm the weight of the package. Excessive quantities of the same item are also one of the important bases for being considered a commercial package, so please try to avoid using the same package to send a large number of a single product.

In addition, due to customs policies, please choose food items with caution.

The above information is collected and collated from Internet data and is only for reference and does not constitute standard guidance.

Customs clearance instructions:

Customs clearance costs for non-duty-free/non-ioss proxy service routes will be borne by the user. Customs inspections are basically in the form of random inspections. If the customs considers your package to be special (for example: large in size, too heavy or contains sensitive items, etc.), the customs will generally contact the recipient to provide an invoice or customs clearance documents (the cost of customs clearance is borne by the recipient). If the recipient cannot be contacted or the recipient does not cooperate in actively contacting the customs for customs clearance, the costs incurred will be borne by the recipient.

If you need a customs clearance invoice, you can apply for it from the platform or contact the online customer service to obtain it.

From January 1, 2021, the UK tax reform will cancel the VAT exemption for goods below 15 pounds and change it to 0 pounds, that is, goods with a declared value of more than 0 pounds will be subject to VAT by the customs. Users who purchase and transport goods on the platform will be borne by you.

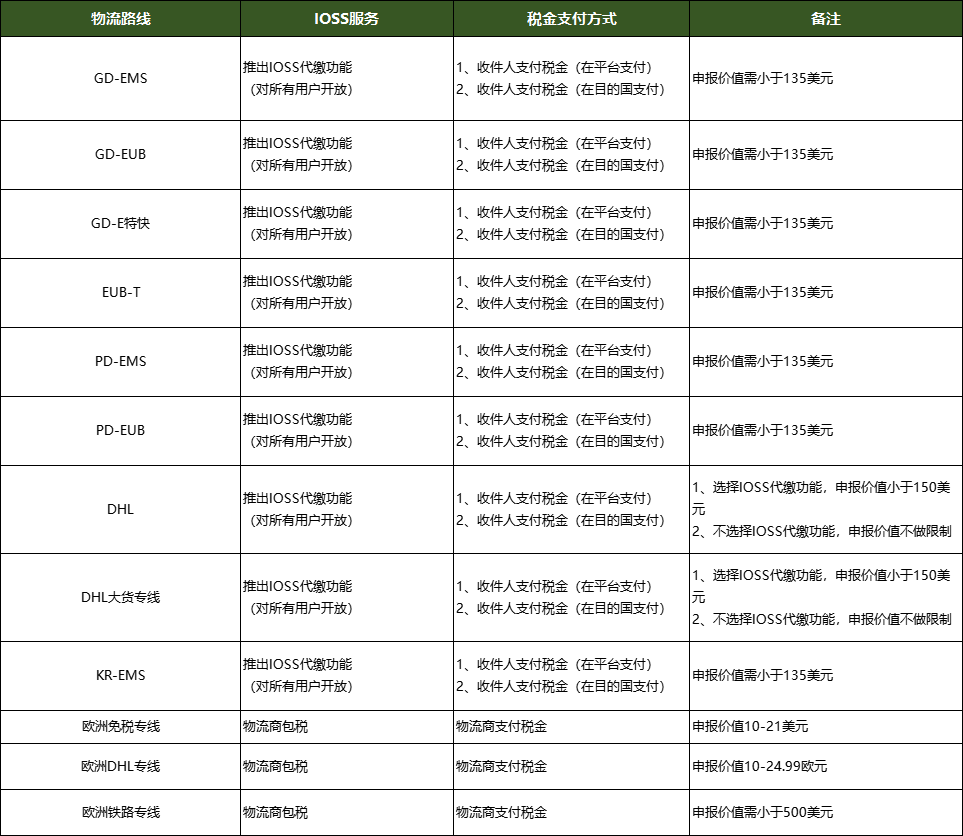

From July 1, 2021, the EU tax reform will cancel the VAT exemption for goods below 22 euros and change it to 0 euros, that is, goods with a declared value of more than 0 euros will be subject to VAT by the customs. At the same time, the EU has launched IOSS (one-stop import service), and it is recommended to declare VAT through the IOSS number for goods below 150 euros. Some logistics routes on the platform provide IOSS services, and taxes are calculated and collected according to the VAT fixed tax rates of EU countries and the amount of your package declaration. You can choose whether to use the platform IOSS to pay taxes on your behalf according to your needs. The following are relevant routes for your reference:

Warm Tips:

1. For parcels using IOSS services, the total declared value cannot be modified after the parcel is submitted. If modification is required, please cancel the parcel and resubmit it.

2. For parcels using the IOSS service, the minimum declared amount will be limited to 30% of the value of the contents of the parcel, and the maximum declared value will be determined according to different routes.

3. The IOSS agent tax payment service simplifies the tax collection process, speeds up customs clearance, and improves customs clearance efficiency. However, it does not guarantee that the customs clearance time limit for your parcel will be shortened. Please refer to the operating time limit of the customs of the destination country for details.

4. If your parcel uses the IOSS agent tax payment service, the platform will pay the tax on your behalf. However, it does not guarantee that your parcel will not be taxed twice by the customs of the destination country. If you face this situation, Tao Jiyun recommends that you cooperate with the local customs to re-clear customs and pay taxes. After receiving the parcel, you can contact us with the tax bill and payment certificate to refund the tax paid by the platform.

5. In order to protect the rights and interests of users and platforms, Tao Jiyun cannot provide you with the IOSS number used by the platform.

Download APP

Download Taojiyun APP

More convenient query

Customer Service

Scan the QR code to add WeChat

17154831823

Scan the QR code to add WhatsApp

54271072

Line

Scan the QR code to add Line

@269trfre